I’ve purchased both types of investments and will use my historical data and personal experience to unlock what is really a better option. The outcome might surprise you.

Drawing on my own historical data from purchasing a pre-construction condo in Toronto’s trendy King West I am going to turn back the clock and do a little comparative analysis on purchasing both resale and pre-construction condos. Ready? So here goes

By the Numbers:

Pre-Construction: Buying Charlie condo at King & Spadina in Toronto

The property

2008 purchase: 561 sq/ft 1 bedroom + den for $269,000

The down payment: 15% (or $40,350) is due within 18 months of signing and another 5% (or $13,450) is due upon occupancy (which turned out to be October 2013).

I was paying occupancy fees for approximately 6 months until the building registered. That worked out to $1,500/month, or a total of $9000. What are occupancy fees? Basically it’s rent. Since you don’t actually own the unit and have possession of the property you need to pay the developer to stay there. Some newly built condos have had occupancy fees for 24 months! Imagine just paying ‘rent’ for 2 years instead of paying down your mortgage.

At the time of registration (April 2014) the closing and developer costs were due and were in the upper end of the spectrum (around 3% of the sale price) which worked out to $8,000. These fees include city development charges, utility connection fees, HST on appliances and other applicable legal fees.

So from the date of signing the Agreement to Purchase & Sale to registration was about 5 years of holding onto this investment.

If I were to sell right away what would my return look like?

My mortgage upon closing was $215,200*

*Note: in a real world scenario if I were to sell this unit immediately after closing I would not only have to pay capital gains taxes to the government, but depending on what mortgage and bank I chose there could be some hefty early termination fees for breaking the mortgage. I haven’t factored either in on this scenario.

In 2014 units in this area of the entertainment district with a similar size were going for about $680 sq/ft.

So 561 sq/ft x $680 per sq/ft = $381,480 selling price

Lets break it down

Initial investment for the unit:

- 15% down payment of $40,350

- 5% final payment of $13,450 due April 2014 (i.e.possession)

Other costs:

- $9,000 for occupancy fees

- $8,000 for closing costs that were due at the time of registration (2014)

- $2,000 staging and website

- $19,074 Realtor fees for selling (5%)

Profit from the sale: $381,480 (selling price) – $215,200 (mortgage) – $53,800 (initial deposit) – $38,074 (other costs) = $74,406

Resale Condo: Buying a unit in The Hudson (right beside Charlie condo)

The property

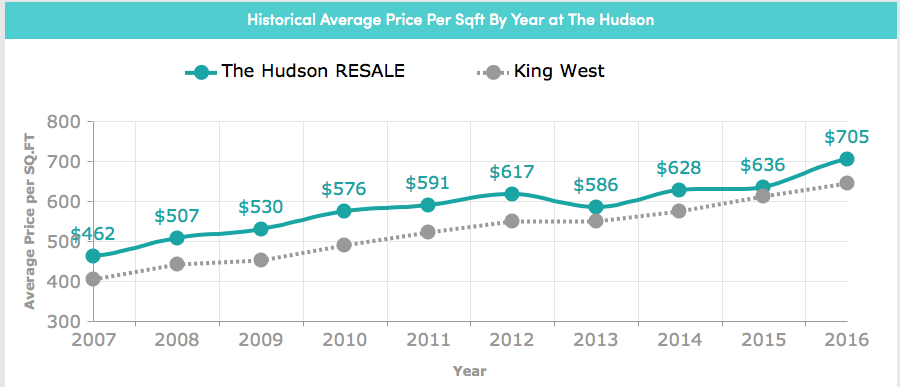

2008 purchase: 561 sq/ft 1 bedroom + den for $284,427 (selling price was $507/sqft)

The down payment: $56,885* (20% down)

Closing costs (includes land transfer tax) = $7,260

Total payable on possession: $64,145

*Because the unit is intended to generate income we are not eligible under the CMHC guidelines for a 5% down payment. Therefore we will need to come up with 20% down to qualify for a mortgage.

Now lets assume we lock in a 5 year fixed mortgage @ 2.99% (about the average in 2008) for $220,282. If we stretch the amortization to 35 years (yes it is still possible to do this) our monthly mortgage cost is $844.26. Remember guys, the key in this strategy is to reduce your monthly expenditures therefore increasing your positive cash flow and exit at the end of your 5 year term.

At the end of the 5 year term you would be left with a mortgage of $200,980

Throw in property taxes of approximately $2,500 a year and maintenance fees of .50 per sq/ft and your monthly carrying costs are $1,333 all in.

Comparing your unit to others in the area for market rents you realize that you can rent out your unit for $1900 per month. Lets assume no rent increases over 5 years (highly unlikely!). That gives you a total monthly profit of $567 or $34,020 over the 5 year period.

In 2014 units in this area of the entertainment district with a similar size were going for about $628 sq/ft.

So 561 sq/ft x $628 per sq/ft = $352,308 selling price

Lets break it down

Initial investment for the unit:

- 20% down payment of $56,885

Other costs:

- $1200 for condo insurance

- $7,260 for closing costs that were due at the time of purchase in 2008

- $2,000 staging and website

- $17,615 Realtor fees for selling (5%)

Profit from renting (2008-2014):

- $34,020 in a 5 year span

Profit from the sale: $352,308 (selling price) + $34,020 (rental income) – $200,980 (remaining mortgage) – $56,885 (initial down payment) – $28,075 (other costs) = $100,388

Pre-Construction vs Resale: The Scorecard

Pre-Construction condo profit: $74,406

Resale Condo profit: $100,388

By going the resale route you can see that you’ve walked away with a cool extra $25,982 (or 35% more profit) in your pocket over and above the pre construction condo. That’s even when you factor in that you’ve paid fair market value for your resale condo as opposed to the ‘discounted rate’ set out in the pre construction advertising.

The winner by unanimous decision: the resale condo

Note: As mentioned, I’m simplifying the first pre-construction scenario by actually taking out the costs associated with breaking the mortgage which can factor in quite heavily if you picked the wrong mortgage product for this strategy.

Going this route? Contact me and I’ll help you structure your mortgage so this doesn’t affect your payout.

To stay on top of the Toronto Real Estate Market and Learn Financing Tips Subscribe to my Newsletter